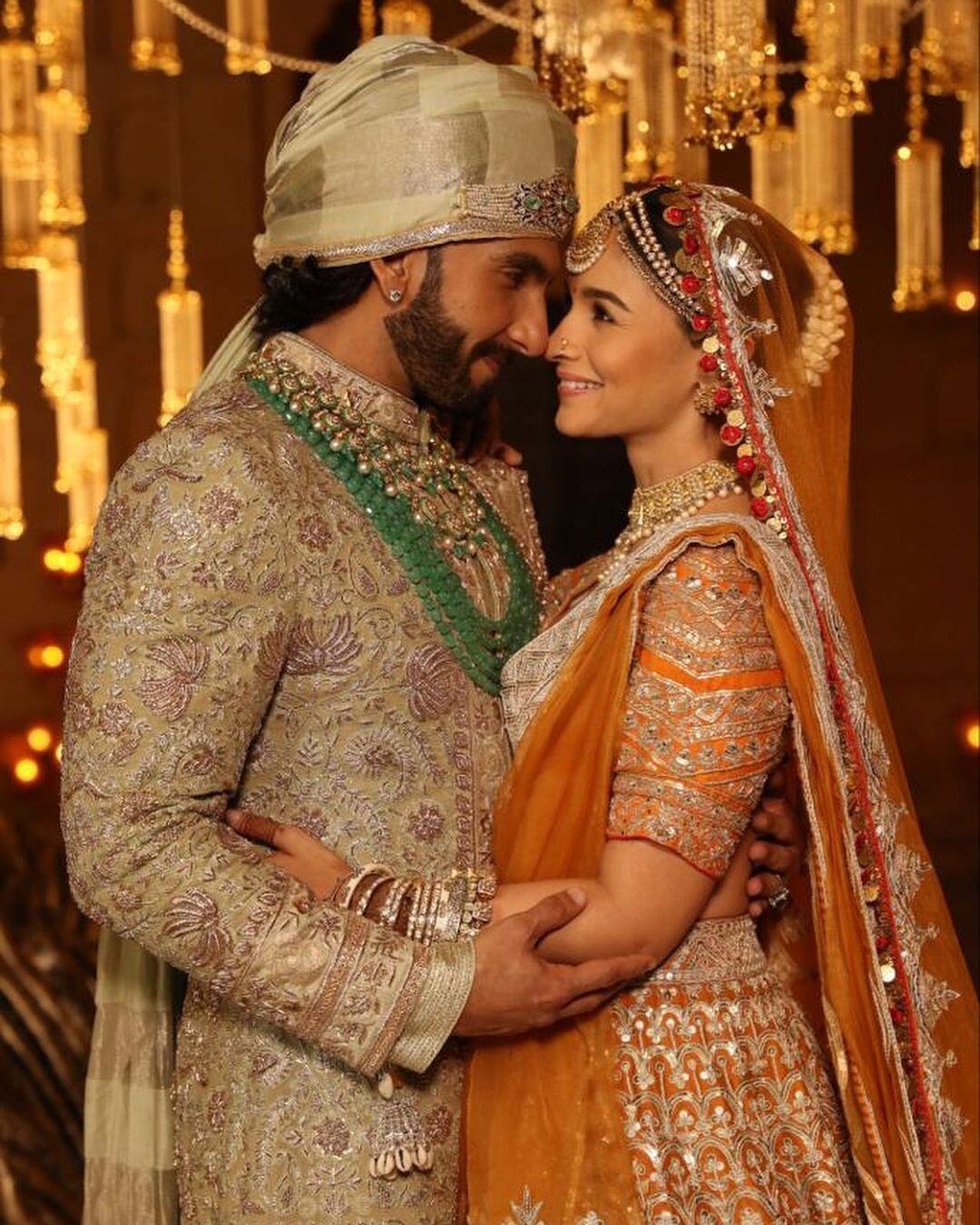

Tips for discussing money with your husband-to-be

Money is an important concern. Right from your approach to finance, existing loans either of you have and other pertinent issues, here are a few tips that will help you speak about money with your spouse.

Many couples hesitate to talk about financial matters before their wedding and prefer leaving it to their families because they fear coming across transactional to their spouse-to-be. However, there are some conversations that must be had for the health and sanity of your relationship. Money is an important concern. Right from your approach to finance, existing loans either of you have and other pertinent issues, here are a few tips that will help you speak about money with your spouse.

Ask them about their existing debts

Some couples choose to keep their finances separate even after the wedding. Even if this is your preferred approach, you must be aware of what loans or debts your husband-to-be has amassed before the wedding. Do they have a good credit score? Do they always pay off their debts in time? Are they already on a payment plan to diminish the list of creditors? These are crucial matters that must be spoken about.

Have a mutual discussion on ways to manage your money as a team

Whether one of you is a dependant or both are bread winners, you need to know who will pay the bills, who will save and who will pay off debts including any that crop up during the wedding. If you have this talk after the wedding, then you may be alarmed to hear that they expect your parents to pay off certain of your bills or debts after the wedding. So, it is best to be upfront in these matters and have a heart to heart talk where you clear all your concerns.

Find out their approach to personal finance

It is critical that you understand their ‘money style’ because studies show that most newlyweds fight the most over money matters. So, you must have similar money styles so that you are onboard about how to spend your collective wealth. As money would be in joint accounts after marriage, you must ensure that one of you isn’t merely a spender while the other is a saver. It would mean a lot of angst to watch your partner blow through your savings merely because they don’t believe in saving for a rainy day.

Discuss this beforehand so you can work together to be on the same page about finances.

ALSO READ: Tips to deal with a pushy mother-in-law before your wedding

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL