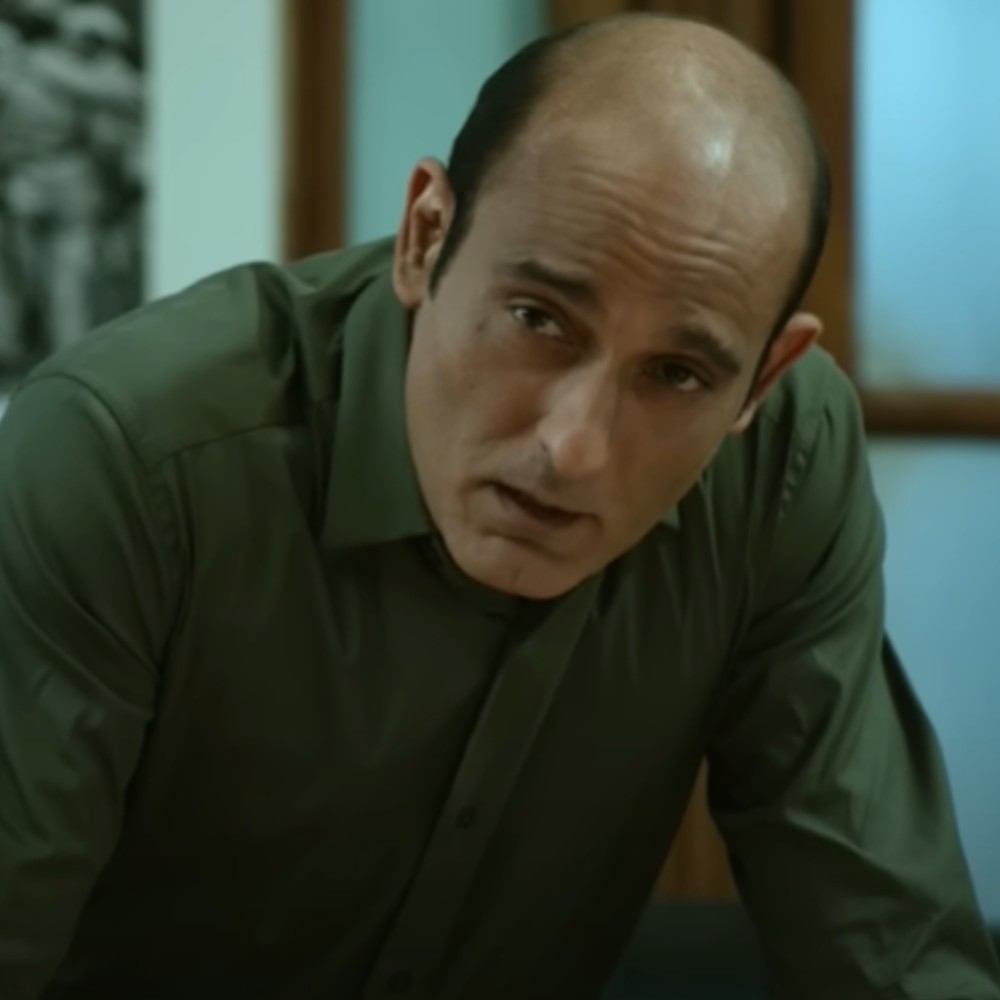

AR Rahman’s Income Tax controversy: Here’s what led to the case against the composer

A couple of days back, news came up stating that the Income Tax department has moved the Madras High Court against AR Rahman.

A couple of days back, AR Rahman’s name came up online stating that the Income Tax department moved the High Court, and filed a case against the composer. Now, reports have come up explaining what really happened in the case. Apparently, the Oscar-winning composer signed a 3-year agreement with a US-based company, and he was paid Rs 3 crore for the same. However, AR Rahman asked them to send the said amount to his trust’s account.

This became an issue as all of the trust’s income would be exempted from tax under Section 11 and 13 of the Income Tax Act 1961. Had he received the amount directly to his account, he would have paid the tax, says the senior standing counsel for the income tax department, TR Senthil Kumar, according to The Times Of India. Apparently, this act is also violation under Foreign Contribution (Regulation) Act, 1976, as it involves fund from overseas.

ALSO READ: Fahadh Faasil says C U Soon was an experiment as everyone's lives turned digital during the lockdown

The English magazine quoted TR Senthil Kumar as saying, “He had entered into a three-year agreement with a company in the UK to compose ringtone for them, for which, an amount of over ` 3 crore was agreed to be paid. But he had said that the amount could be sent to his foundation. For a trust, if it fulfills some conditions, all its income would be exempted from tax under Section 11 and 13 of the Income Tax Act 1961. By routing the full money to the trust, he does not want to pay tax.”

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL