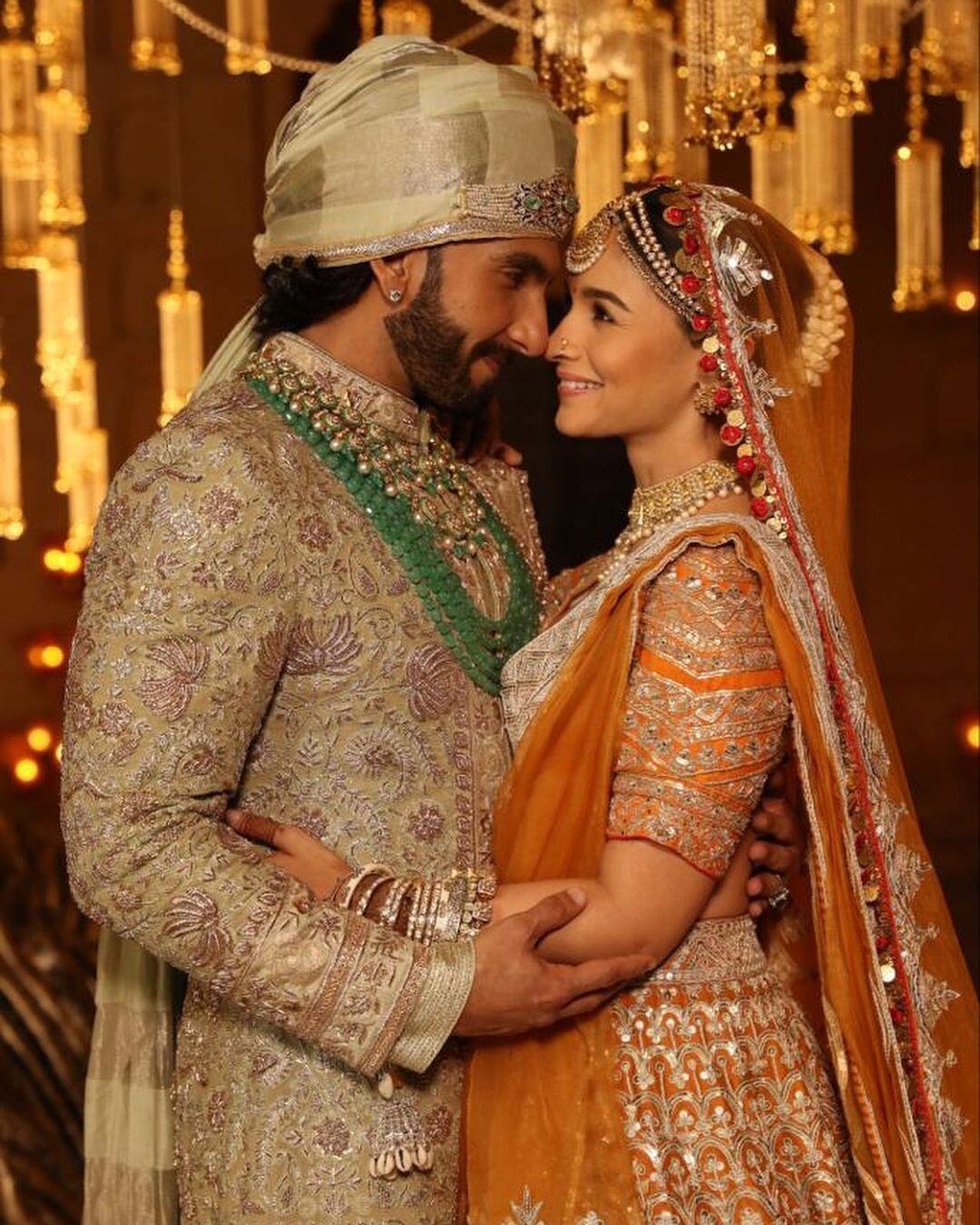

A couple's guide to combining finances after marriage

Matrimony and cohabitation are all about working together to build a home with your partner. But almost every married couple would admit that they’ve had their fair share of squabbles when it comes to discussing how to combine their finances. So we bring you a short but concise guide on how to share the financial burden in a marriage.

Matrimony and cohabitation are all about working together to build a home with your partner. But almost every married couple would admit that they’ve had their fair share of squabbles when it comes to discussing how to combine their finances. However, armed with candour, patience and a quick guide to joint finances, you and your spouse can sail through the tough stuff like a breeze. So we bring you a short but concise guide on how to share the financial burden in a marriage.

How to combine your finances

While starting off, the two of you probably have separate bank accounts and separate credits cards and investments. However, if you wish to combine your money, then you may want to talk about sharing your bank accounts or starting a joint account together. This can be used to pay off household expenses and save money for your future together.

Ascertain each of your priorities

One of the key lessons in managing your own money is that you should always start by asking yourself what is of importance to you and also the things you want. Begin by sitting down to draft a list of priorities together. Right from monthly savings to investing in a government bond or mutual fund, write down things that each of you need to do and prioritize them.

Chart out a budget for household expenses

Right after figuring out how much each of you earns every month, pen down the fixed household expenses such as rent, electricity bill, water, house help. You must then calculate the money you need to spend on groceries and commute to work. Drafting out a combined budget lets you plan your own expenses as well as those of your children, so should you need to cut down on expenses, you know exactly where to begin.

Such a spending strategy shall help you work towards your goals as a family while avoiding chances of miscalculations or confusion.

ALSO READ: How not to resent a spouse for being financially dependent on you

JOIN OUR WHATSAPP CHANNEL

JOIN OUR WHATSAPP CHANNEL